Next Tuesday, voters across the county will decide on some 300+ ballot measures that will use tax increases to fund transportation improvements. With the help of our friends at the Eno Center for Transportation, we are exploring how these measures are distributed across California and the county.

These measures could raise nearly $200 billion for transit investments, and billions more to fund improvement of roads, rail and freight. The federal gas tax, traditionally the nation’s primary source of transportation funding, has not been raised in 22 years. In 2014, only about 27 percent of transportation funding was federal, dropping from a high of 35 percent in 1980.

Simultaneously, the nation’s transportation infrastructure is in dire need of investment simply for maintenance, not to mention investment in new roads and transit infrastructure. The American Society of Civil Engineers estimates that $170 billion in capital investment is needed annually to improve road conditions across the county, with transit, rail, and ports in similar states of disrepair. Transportation funding needs have been a frequently visited topic of the presidential candidates.

As federal fuel tax revenues and other sources of federal funding for transportation continue to decline, financial responsibility has increasingly shifted to states, counties, and local governments. As of 2011, approximately 30 percent of total transportation funding came from local governments, largely funded by tax ballot measures. So called “self-help” counties that can provide tax funding for local transportation projects also have an advantage in the competition for scarce state and federal funding. (SGV Tribune).

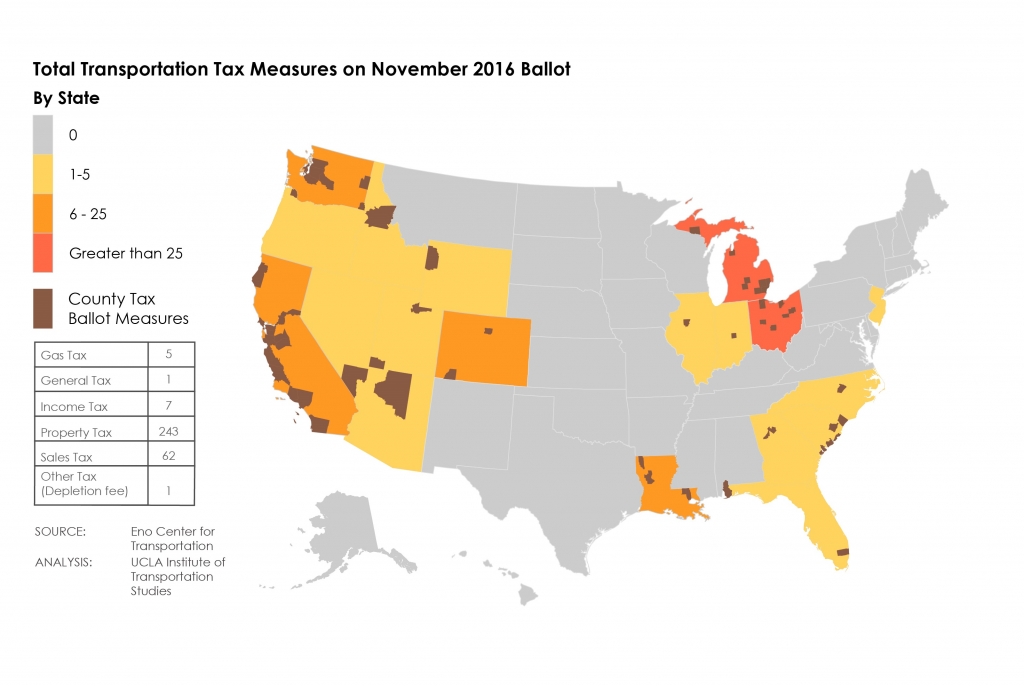

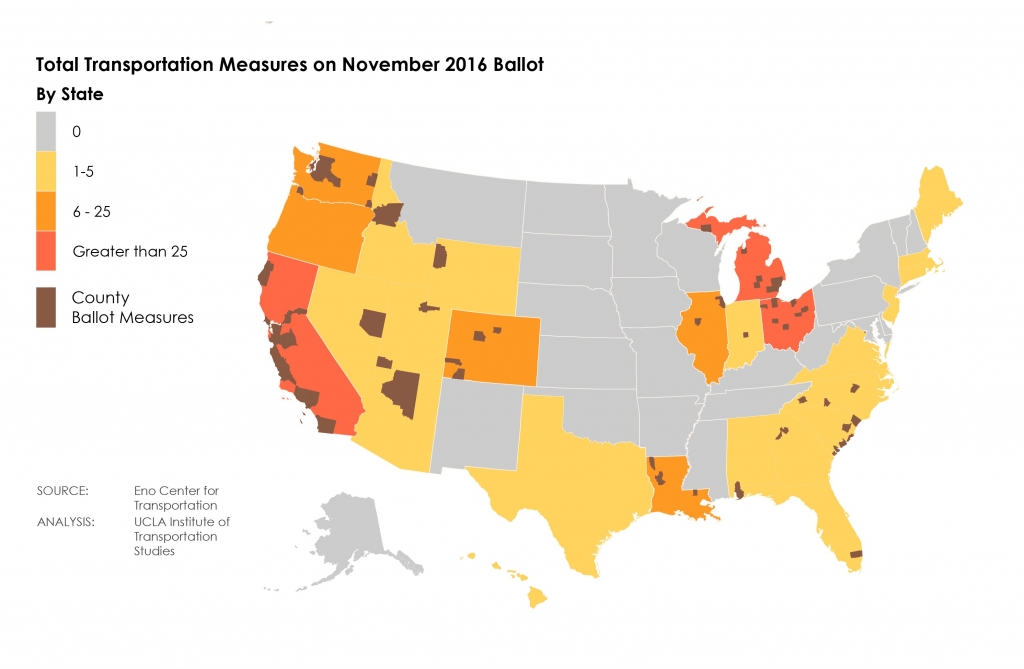

These maps illustrate the widespread reliance on transportation ballot measures, and also reveal geographic differences in the popularity of ballot measures and the type of taxes used to fund transportation.

- Transportation taxation ballot measures are most popular in the West, the Southeast and the Great Lakes region. Is this purely a function of state enabling laws for ballot measures? Are transportation tax measures more popular in areas of rapid growth?

- Property taxes are by far the dominant form of transportation ballot measure. State law in some places also dictates the type of finance mechanism. For example, the popularity of county-wide sales tax measures in California is partially due to laws limiting the uses of property tax revenues.

Transportation ballot measures aren’t for taxation purposes alone. Bond measures, constitutional amendments and advisory requests are all up for votes next week. Dozens of governments are asking voters to approve advisory measures requesting authority for red light cameras or authorize funding extending existing transportation projects.

The UCLA Institute of Transportation Studies, along with the Eno Center for Transportation, is keeping a watchful eye on these ballot measures. UCLA ITS specializes in supporting innovative transportation finance solutions through faculty expertise and research projects. Current research projects examine what motivates voter-acceptance of these measures, the equity implications of sales tax measures, and the rich history of transportation ballot measures in Los Angeles County.

Written by UCLA Urban Planning PhD Student, Jaimee Lederman. Maps and analysis by UCLA Institute of Transportation Studies Associate Director, Madeline Brozen. Special thanks to Emily Han, Eno Center for Transportation.

—

Our 2016 UCLA Arrowhead Symposium focused on the needs to invest in sustainable mobility. Presentations are available at this link.